A Unique Business Downturn & Environment: It's About the Services Industries

- Joe Carson

- Oct 29, 2020

- 2 min read

The 2020 economy will be remembered for the record plunge in Q2, and its record rebound in Q3. Yet, the most unusual or unique feature of the economy’s performance, and downturn, is its mix.

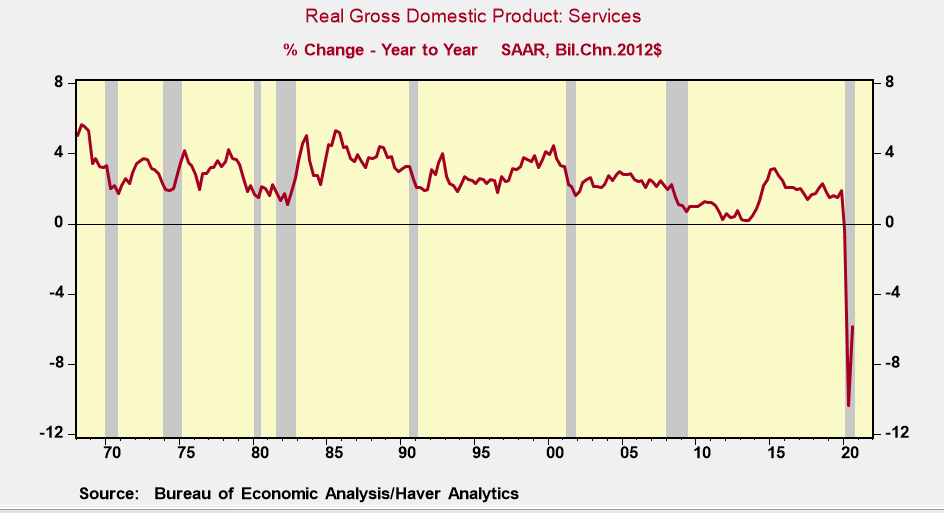

The 2020 downturn is the first economic recession in the post-war period that was largely concentrated in the services industries, instead of the more cyclical sectors, goods and structures. A sustainable recovery cannot occur until the service sector is fully open because it accounts for roughly 60% of GDP and over 85% of the employed workforce.

GDP’s Record Fall and Rebound

According to its advance estimate, the Bureau of Economic Analysis (BEA) reported Q3 real GDP increased at an annual rate of 33.1%, following the 31.4% drop in Q2. The three product sectors all posted record advances, led by goods up 59%, services 24%, and structures 16%.

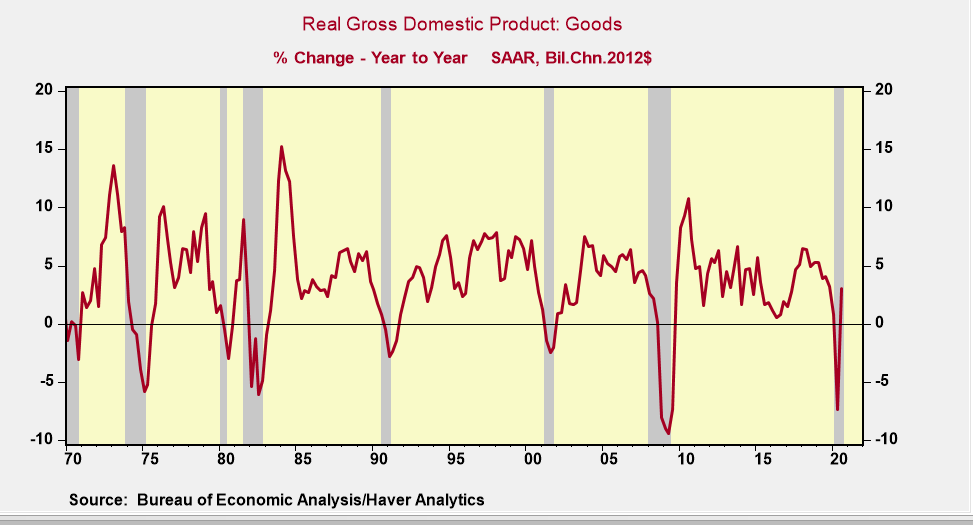

Even with the record rebound, the level of Q3 real GDP is still $500 billion (annualized) below that of Q1. That deficit is centered on the output of the services industries, while output in the goods sector has rebounded to a new record high. Both are unique features as the goods sector never recovers so quickly and the service sector never contracts.

According to the GDP data, the Q3 output of the service industries, which includes health care, transportation, education, and recreation and entertainment, stands $500 billion below that of Q1. That deficit is so large that for the first time in the post-war period the service has posted a contraction over the past 12 months.

Contrast that performance with the more cyclical goods sector. In Q3, the output of the goods sector, which includes the production, distribution, and retail selling of products, jumped to a new record high, recovering the entire decline in Q2 and more.

The recovery in the goods sector has been in part powered by the recession in services. That is, spending that would normally be directed towards consumer services such as travel, hotels, recreation, and entertainment has been shifted to household goods and products.

But that shift in spending patterns has a limited life. That’s because private and public service industries account for 85% of all jobs, which in turn generates the income to spend on goods and services. The partial re-opening of the economy has triggered a rebound in service sector employment. However, September’s service sector jobs were still 10 million below the levels in early 2020.

Failure to legislate another round of federal stimulus at the same time the number of COVID cases are rising to record levels forcing states and localities to impose new restrictions on businesses raises the risks of more layoffs and a weaker spending impulse in coming months. The GDP rebound in Q3 was most impressive, but too much of the service sector remains partially closed for recovery to be sustained without more fiscal assistance and progress on the medical front.

Comments