The Misread of Labor Market Conditions and The Misuse of Monetary Policy Tools

- Joe Carson

- Oct 25, 2021

- 2 min read

Policymakers have repeatedly misread inflation dynamics and appear to make a similar misread of the labor market. Post-pandemic labor market conditions are not identical to pre-pandemic. Rising wages and worker shortages suggest the full employment/unemployment rate is probably one to two percentage points higher.

Yet, policymakers are unconvinced that labor market conditions have changed. Fed Powell expects lessening supply-side constraints would create a more balanced labor market and relieve wage pressures. As such, Powell wants to maintain low rates to "give full time" for labor markets to rebalance.

The misread of labor market conditions will inflame them more while maintaining low rates will increase the odds of a structurally higher inflation rate.

Labor Market 2021

Labor market conditions change from cycle to cycle, but none faster than what has happened from pre-pandemic to post-pandemic. The current economic recovery is only a little more than a year old, and after nearly 12 million people fining employment, job openings of over 10 million are near record levels. And people switching jobs are seeing the most significant pay increases in more than twenty years.

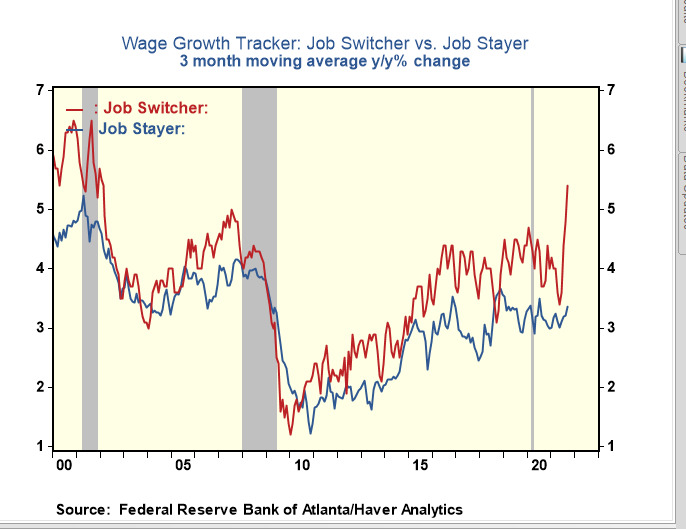

The Federal Reserve Bank of Atlanta has created a wage gauge that separates wage gains for people who stay on the job and those who decide to switch. People who have remained at the position have seen wage gains of about 3.5%, comparable to wage trends before the pandemic.

However, job switchers have experienced wage gains of 5.5%. That's 100 basis points over the pay increases offered in early 2020. At the beginning of 2020, the jobless rate was 3.5%, and the average of Q3 2021 was 5.1%. Switching workers getting significantly higher pay increases at a higher unemployment rate suggests the full employment/unemployment rate had moved up. How much higher? Probably one to two percentage points.

The ability of companies to attract workers is also an indicator of how tight labor markets are. A record 60% of small firms, according to the National Federal of Small Businesses, say that they cannot find qualified staff. At the start of the prior three business cycle upturns, that number was around 30% and sometimes less.

Macroeconomic conditions are the primary focus of monetary policy. Yet, Fed Chair Powell wants to maintain its zero-rate policy as he wants to give more time for segments of the service sector hard hit by the pandemic to recover. Trying to support a specific industry or part of the workforce is a misuse of its policy tools. That's the role of fiscal policy, not monetary policy.

Misreading inflation and labor market dynamics raises the risk that both become more entrenched. Consequently, the policy adjustment will be more significant at some point, with unavoidable adverse effects on all industries and segments of the workforce, not just the sectors targeted.

Comments