Pioneer of the Inflation Targeting Adds Asset Prices to Its Framework, While The Fed Adds More Fuel.

- Joe Carson

- Feb 28, 2021

- 2 min read

Starting March 1, The Reserve Bank of New Zealand (RNZ) will consider the impact on housing prices when it debates monetary policy decisions. In doing so, RNZ becomes the first central bank to acknowledge that monetary policy decisions could influence asset prices at times adversely---lifting valuations far beyond fundamentals.

RNZ argues that the inclusion of house price sustainability fits in with their financial stability mandate. RNZ would be using prudential tools – like loan-to-value ratios, bank stress testing, and capital requirements against particular types of mortgage lending---when it decides whether monetary policy action is needed to "ensure house price sustainability."

News that RNZ now includes asset prices in its policy deliberations has been ignored or overlooked by most. Critics may say it's a small country, and their approach to monetary policy should have no carryover or import to what others do.

But that would be wrong. RNZ pioneered the inflation-targeting framework, introducing this policy regime in 1990; since then, it has been adopted by central banks worldwide.

One would think that the central bank that created and has been using the inflation-targeting framework the longest would know a lot about the pros and cons of this approach more than anyone else. RNZ has learned, as have other central banks, that a simple inflation-targeting rule to conduct monetary policy is not easy or without unintended consequences.

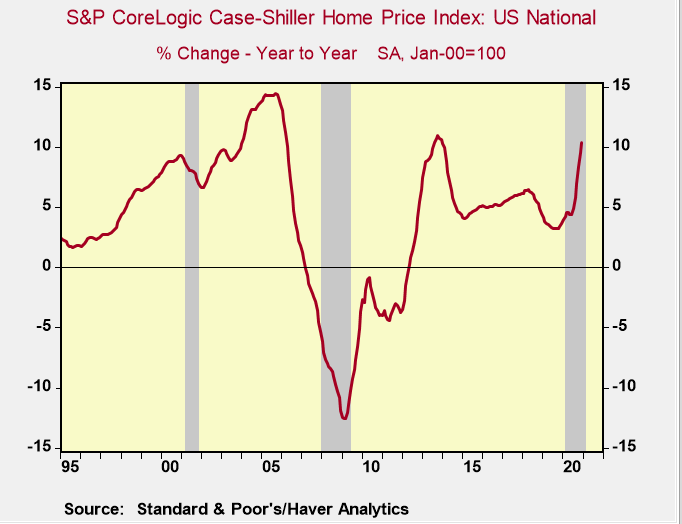

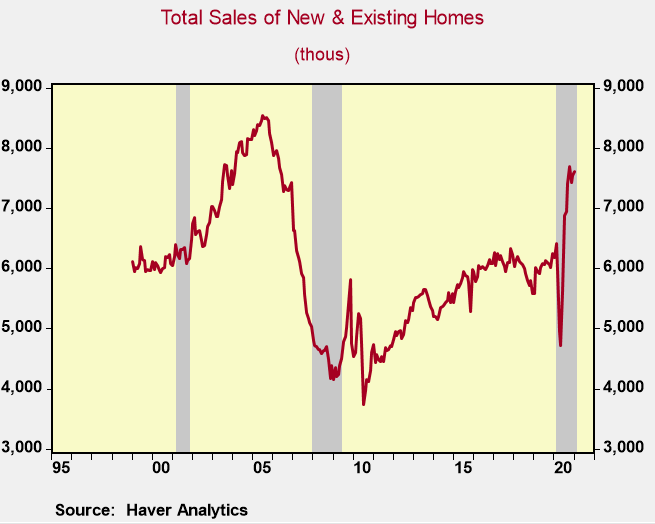

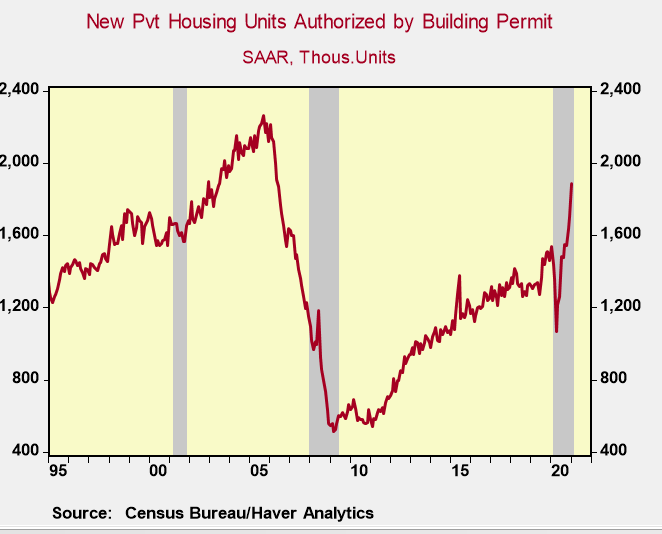

Boom-bust credit and asset cycles have been two of the unforeseen side effects of inflation targeting. In the US, boom-bust asset cycles, linked directly to easy money policy and the promise to maintain it for an extended period, triggered the last two recessions.

Central banks have for decades struggled with how to incorporate financial stability issues (i.e., unhinged gains in asset prices) within the structure of the inflation-targeting framework. The decision by RNZ puts financial stability as a co-equal to that of price stability. It would be wise for other central banks, including the Federal Reserve, to consider the actions by the RNZ.

Unfortunately, the Federal Reserve does not appear to be on the same page. Unlike the RNZ who is now monitoring monetary policy influence on asset prices, the Fed adds fuel to the asset price boom.

When testifying before Congress last week, Mr. Powell stated, "The housing sector has more than fully recovered from the downturn." That is an understatement. The housing sector is booming, evident with record-high prices, following double-digit gains in 2020, and sales of new and existing homes and permits to build new ones at the highest levels since the housing bubble mid-2000s.

But even after acknowledging the robust housing sector, Powell said the Fed would continue with mortgage-back securities purchases providing more monetary fuel to a red-hot sector.

Senator Pat Toomey, the Republican senator from Pennsylvania, suggested to Mr. Powell that the Fed's easy money policy contributes to "bubbles," citing rapid increases in real estate, commodities, and other assets. Mr. Powell admitted, "There is certainly a link," but cited other factors as well.

With asset prices at record levels, the RNZ and the Fed employ diametrically opposite policies to ensure price and financial stability. Who is right? My money is on the tiny central bank on the other side of the world.

Comments