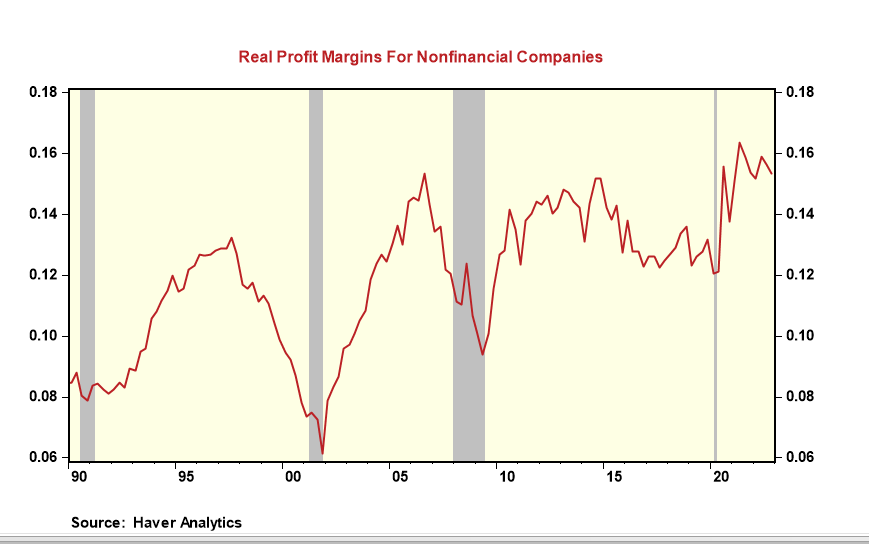

Near-Record High Real Profit Margins Indicate Fed Has A Lot More Work To Do

- Joe Carson

- Mar 30, 2023

- 1 min read

Nonfinancial Companies' real profit margins at 15.4% for Q4 2022 were unchanged from one year ago. That's a remarkable performance because companies could navigate a rising rate environment and wage pressures and maintain near-record high margins. That also helps to explain why there has yet to be a significant rise in the unemployment rate-- -no need to get rid of people with near-record high profits margins. The path to weaker labor markets and reduced inflationary pressures come from declining profit margins---the margin data indicates that the Fed has a lot more work to do.

Great blog, Joe! Do you watch the velocity of money? Based on the quantity theory of money (money supply × velocity of money = price level × real GDP), changes in velocity are directly proportional to the inflation rate. It's reported with a lag, but this morning's latest report on velocity shows that it seems to be accelerating: Velocity of M2 Money Stock (M2V) | FRED | St. Louis Fed (stlouisfed.org) I agree that the Fed has more than one additional rate rise up its sleeve.