Growth in Nominal GDP & Bank Credit Says Monetary Policy Remains Too Easy

- Joe Carson

- Jan 26, 2023

- 2 min read

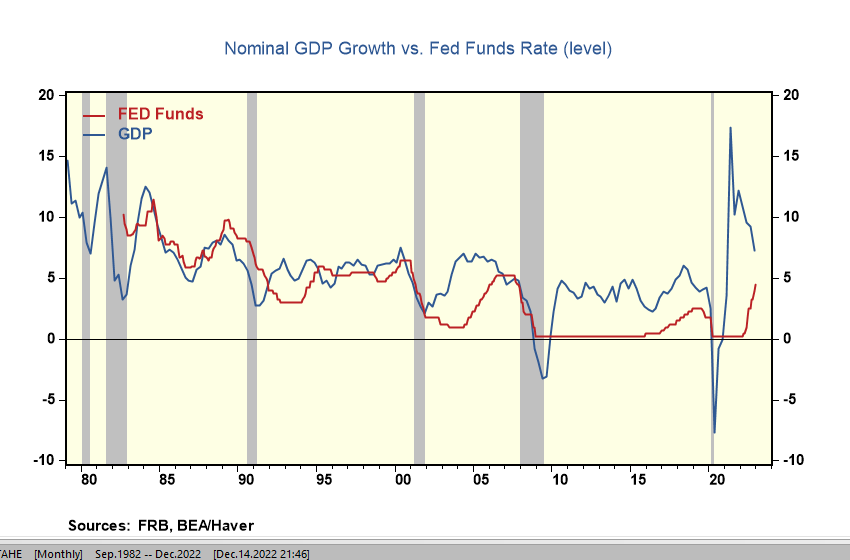

Is the stance of monetary policy tight? Based on growth in nominal GDP, the answer is a clear no.

In 2022, Nominal GDP grew 7.3%, and the Federal Reserve raised official rates by 425-450 basis points. What is most unusual with that outcome is that nominal GDP growth still exceeded the fed funds rate by roughly 300 basis points. History shows that significant Fed tightening cycles always produce a much more substantial slowing in nominal GDP. Also, the Fed's tightening ends long after the fed funds level exceeds nominal GDP.

Since the mid-1980s, the Federal Reserve has embarked on four (late 1988-90, 1994-95, 1999-2001, and 2004-07) significant tightening cycles to reverse or preempt cyclical inflation pressures. The scale of those four tightening cycles averaged 300 basis points, ranging from 150 to 425 basis points. Each tightening process resulted in a significant slowing in Nominal GDP, dropping in most cases below 3%.

Even though the Fed has raised official rates by the most significant scale since the early 1980s, it has yet to close the gap with nominal GDP growth. The 7%-plus growth in nominal GDP is 300 to 400 basis points over what would be consistent with the Fed's 2% inflation target.

History shows as long as the growth in nominal output and income exceeds the level of interest rates, the economic cycle (and the inflation cycle) are alive and well. The 12% growth in bank credit in the past year, the most considerable calendar growth rate since 2006, sends the same message as nominal GDP--monetary policy remains too easy to break the inflation cycle.

Investors will cheer if policymakers raise official rates by 25 basis points at next week's FOMC meeting. Yet, the longer the Fed fails to close the gap between fed funds and nominal GDP, the greater the risk is that they will have to raise official rates by more later.

Comments