Apples-to-Apples: Consumer Price Inflation Is Nearing 1970-Type Numbers

- Joe Carson

- May 21, 2021

- 2 min read

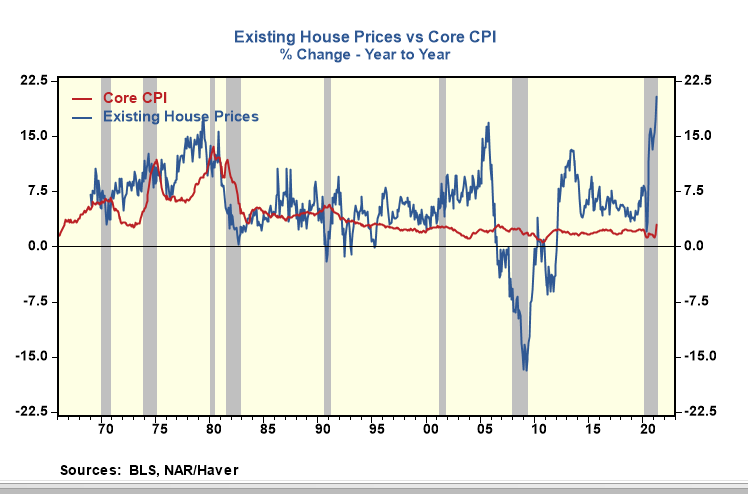

Apples-to-apples, consumer price inflation nowadays is running close to the high inflation readings of the late 1970s. That should be a red flag for policymakers as monetary decisions are focused on actual outcomes, not forecasted. But reported inflation statistics do not show the 1970s inflation-style inflation because they no longer include actual house prices.

The old consumer price index included house prices in measuring the owner's housing cost, whereas the present-day price index base owners' housing cost on an arbitrary, non-market rent measure. The only way to make a price series strictly comparable over time is to use the same measurement process.

In April, the median price for existing homes increased 20.3% in the past twelve months, a new record and far above the 1970s high-reading of 17.4%. More importantly, the increase in existing house prices is ten times greater than the 2% increase in non-market rents in the consumer price index.

Owners rent index accounts for nearly one-quarter of the overall consumer price index and a full one-third of the widely followed core index. Inserting actual house prices in place of the non-market rents would add roughly five percentage points to 4.2% headline and 3% core inflation readings. The last time the US consumer price inflation ran that high was during the 1978 to 1982 time frame.

Just because reported inflation statistics no longer include actual house prices does not mean a rise in house price is not a sign of increased inflation and higher inflation expectations. If an increase in house prices is not inflation, then what is it?

One would think the current generation of policymakers would include house prices in their policy framework since it is an inflation-related outcome directly linked to monetary policy.

Inflation cycles don't end well, and the odds of a bad outcome should be measurably higher when policymakers are unaware that monetary policy is fueling an unsustainable price cycle.

Comments